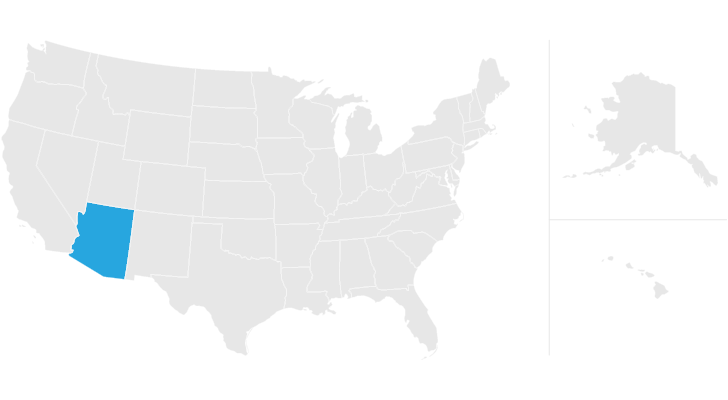

arizona estate tax return

The estate has a beneficiary that is not an Arizona resident. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

Gain An Understanding Of The Different Designs Of Trusts Centered Around Dynasty Trust Dynasty Trusts Are Incre Estate Planning Continuing Education Estate Tax

It allows the states residents who have a sufficient estate to reduce its taxable part legally without any adverse fiscal side effects.

. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. If it is incorrect click New Search. Tax Information for Individuals.

31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can learn how to complete and file only an AZ state return. This means that on the federal level if your estate is valued at less than 11580000 when you die then your beneficiaries will not have to pay any federal tax on their inheritance. 1312020 - Each surplus lines broker must obtain their OPTins-compatible tax report from The Surplus Line Association of Arizona.

Application for Filing Extension For Fiduciary Returns Only. 2010 Estate and Gift Tax Law Changes. Congress made significant changes to the federal estate tax rules and rates in 2010.

141AZ Schedule K-1 Resident or Part-Year Resident Beneficiarys Share of Fiduciary Adjustment. It allows you to gift away at least 80000 worth of. Any amount over that limit is taxed at a maximum rate of 40.

2016 Estate and Gift Tax Law. By completing line 24 you are authorizing the department to release. Please review the information.

20 rows Income tax return filed by a Fiduciary or Fiduciaries for an estate or. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateHowever if you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyIf you owe Taxes and dont pay on time you might face. Federal law eliminated the state death tax credit effective January 1 2005.

Businesses Self-Employed Arizona Department of Revenue - Tax laws that fall under the departments purview are primarily in the areas of income transaction privilege sales use luxury withholding property estate. Since there is no longer a federal credit for state estate taxes on the federal estate tax. Several of our CPAs are members of the Southern Arizona Estate Planning Council and the Central Arizona Estate Planning Council and attend national estate planning forums.

Arizona Department of Revenue 1600 W. It may take 8-10 weeks to process. The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

This is because Arizona picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return federal form 706 or 706NA. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Arizona also does not have a gift tax.

The federal gift tax has an exclusion of 16000 per done per year. If you want the Department of Revenue to discuss matters relating to this estate tax return with the preparer of this return c omplete line 24 below. The 2021 Arizona State Income Tax Return forms for Tax Year 2021 Jan.

As a result in 2011 and 2012 individuals over the course of their lifetimes could give or bequeath 5000000 indexed for inflation to anyone free of a federal transfer tax. If it is incorrect click New Search. We cannot provide a status at this time.

To claim this credit the total amount repaid during the. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. The current federal estate tax is currently around 40.

The department must be in possession of Form 210 to issue the certificate. Arizona Department of Revenue. Resources for You Internal Revenue Service - The Internal Revenue Service is the nations tax collection agency.

Monroe Room 610 Phoenix AZ 85007. Estate and Gift Taxes Chronology of Federal Estate and Gift Tax Law Changes. At this time Arizona residents with property only in Arizona only need to concern themselves with the federal estate tax.

1312020 - Updated tax forms and instructions are now available from this website and will soon be available from OPTins. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. In 2020 it set at 11580000.

Estate or Trust Estimated Income Tax Payment. The federal inheritance tax exemption changes from time to time. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022.

This exemption rate is subject to change due to inflation. Suppose you have 2 children and 3grandchildren. 14 rows Fiduciary Forms.

Because Arizona conforms to the federal law there is. If needed the personal representative should request the tax release certificate when filing the final income tax return for the estate. Even though Arizona does not have its own estate tax the federal government still imposes its own tax.

Estate Tax Unit Arizona Department of Revenue 1600 West Monroe Room 520 Phoenix AZ 85007-2650. 3182020 - Updated version of the Arizona Retaliation Guide is now available for foreign and alien insurers. We complete over 600 trust returns Form 1041 on behalf of clients every year and we do 5 to 10 estate tax returns Form 706 annually.

Form is used by a Fiduciary to compute a tax credit under Arizonas Claim of Right provisions by identifying an income amount previously reported by the estate or trust that was required to be repaid during the current taxable year and the associated tax that was paid on that income. Complete and mail to. If you have submitted your return 6 weeks ago or less this update means your return is still pending and has not been processed.

Thank you for your inquiry. Please allow more. Even though Arizona does not have its own estate tax the federal government still imposes its own tax.

The certificate request should be mailed to. Arizonas estate tax system is commonly referred to as a pick up tax. As of 2015 individuals with estates under 543 million and married couples with estates under 1086 million are not subject to the estate tax.

The estate and gift tax exclusion amounts were increased.

Caring Transitions Of Southern Arizona Logo Online Estate Sales Caring Estate Sale

Average Tax Refund Climbs To 3 034 So Far This Year Tax Refund Income Tax Return Income Tax

Ontario Land Transfer Tax Tax Debt Tax Attorney Tax Lawyer

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Business Perspective Income Tax

Arizona Estate Tax Everything You Need To Know Smartasset

Hitting The Market Thursday Want To See It Today Move In Ready New Carpet Call Me Text Me 602 758 7135 New Carpet Arizona Real Estate Home Buying

Free Printable Checklist For Use By Executor Legal Forms Legal Forms Printable Checklist Checklist

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

Property Taxes 101 Redfin Estate Tax Property Tax Tax Deductions

Arizona State Taxes 2022 Tax Season Forbes Advisor

Will And Testament Template Free Printable Documents Last Will And Testament Will And Testament Estate Planning Checklist

10 Oldest Cities In The United States Old City City Estate Tax

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Greystone Park Mansion 905 Loma Vista Drive Beverly Hills California Usa Mansions House Design Beverly Hills